Would Southwest Airlines be a good investment?

I said that I’d stop reading the business section of the newspapers (and I stated the reason why here) but sometimes I cannot help it.

And an article – travel related – drew my attention ‘Southwest’s new legacy shouldn’t strand shareholders’. Actually it was the first paragraph that made me read it: “We know what’s wrong with Air Canada, American Airlines and every other carrier that’s toppled into bankruptcy in the past decade: They weren’t more like Southwest Airlines, LUV the legendary company whose low costs, happy employees and loyal customers have produced 39 consecutive years of profit”.

39 consecutive years of profit, almost unbelievable when most financial news about airlines is how they struggle, have to receive government subsidies and in the end go bankrupt.

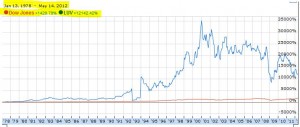

LUV is a good ticker symbol, no wonder it has had such a good run – it has increased 9 times more than Dow Jones since 1978 – everyone wanted to have such a symbol in their portfolio. However, past performance is not a guarantee for future results as more recent comparisons show:

- in the past 10 years; Dow Jones + 28%, LUV -52%

- 5 years; Dow Jones -3%, LUV -44%

- 1 year; Dow Jones -1%, LUV -33%

- year-to-date; Dow Jones +3%, LUV -6%

“Where’s the LUV?” asks the article after it stated: “So it may surprise you to learn Southwest is one of the very cheapest stocks in the S&P 500. Its forward price-to-earnings ratio hovers at around 10. Its enterprise value – net debt plus market capitalization – is 2.3 times its EBITDA (earnings before interest, taxes, depreciation and amortization); only two companies in the S&P 500 index are cheaper by that measure.” It seems the investors don’t like the direction the company is taking by the acquisition of Air Tran. “Southwest is becoming one of the legacy carriers it always won its business from. For years, Southwest built its business by operating one type of plane, which kept maintenance and training costs down, and concentrating on point-to-point leisure travel between second-tier airports with cheap landing fees. It eschewed complicated national and international networks that appealed to business travellers.”

The article concludes in a slightly optimistic note. “Will Southwest ever soar like that again? Possibly not. But for now, the shares have been grounded, and it will only take a small amount of liftoff for investors to profit.”

Should I buy Southwest? Warren Buffett said:

“The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers.”

“As of 1992, in fact—though the picture would have improved since then—the money that had been made since the dawn of aviation by all of this country’s airline companies was zero. Absolutely zero.”

However, it seems Southwest is the exception that confirms the rule. Perhaps I should buy it only to confirm that whatever stock I touch it goes lower:). I would become famous like Midas but for having the opposite effect.

Warren Buffett also said at the Berkshire Hathaway annual meeting some years ago:

“If a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.”

That’s why I’v enever bought it.